Pst Registry Bc

Pst Registry Bc - Web you can register to collect pst by completing the application for registration for provincial sales tax (pst). The business registry manages the creation. Bc personal real estate corporation; Web register to collect pst. Web even if you're not required to register to collect and remit pst, this guide explains how pst applies to goods and services. Web all canadian businesses that sell taxable goods to anyone in british columbia (bc) (business or consumer) will. A provincial sales tax (pst) is imposed on consumers of goods and particular. You can register to collect. British columbia’s expanded provincial sales tax registration requirements to take effect on 1 april 2021. You must pay pst on the total amount you pay to bring the goods into bc, including charges for.

The business registry manages the creation. A provincial sales tax (pst) is imposed on consumers of goods and particular. In its 2020 budget and fiscal plan, dated february 18, 2020, british columbia (b.c.) announced that it would. Visit bcregistry.gov.bc.ca to find out which bc registry services you can use. You must register to collect pst if you are located in b.c. Web to register to collect and remit bc pst you need to fill out the application for registration for provincial sales tax form. Web in provincial budget 2020, measures were announced that would require businesses not otherwise carrying on. Web what is pst used for? Web all canadian businesses that sell taxable goods to anyone in british columbia (bc) (business or consumer) will. Web you can register to collect pst by completing the application for registration for provincial sales tax (pst).

You must register to collect pst if you are located in b.c. Web personal property registry record security interests and liens against personal property belonging to british columbia businesses. Web register to collect pst. Keep business records up to date. Web receive the goods in bc. Visit bcregistry.gov.bc.ca to find out which bc registry services you can use. Web register a bc company; A completed pst exemption certificate. Web what is pst used for? A provincial sales tax (pst) is imposed on consumers of goods and particular.

Everything You Need to Know About the Boat Registry in BC

And you sell or lease taxable goods, or provide. The purchaser's pst number, or, if the purchaser doesn't have one, 2. Web register a bc company; A provincial sales tax (pst) is imposed on consumers of goods and particular. Web receive the goods in bc.

setting up BC PST Reconciliation, Deposits, and Banking Sage 50

Web register to collect pst. Web receive the goods in bc. And you sell or lease taxable goods, or provide. A provincial sales tax (pst) is imposed on consumers of goods and particular. Web even if you're not required to register to collect and remit pst, this guide explains how pst applies to goods and services.

PST in BC Online Registration YouTube

And you sell or lease taxable goods, or provide. The business registry manages the creation. A completed pst exemption certificate. British columbia’s expanded provincial sales tax registration requirements to take effect on 1 april 2021. Web you need to register to collect pst if you sell or lease taxable goods, or provide software or taxable services in the ordinary course.

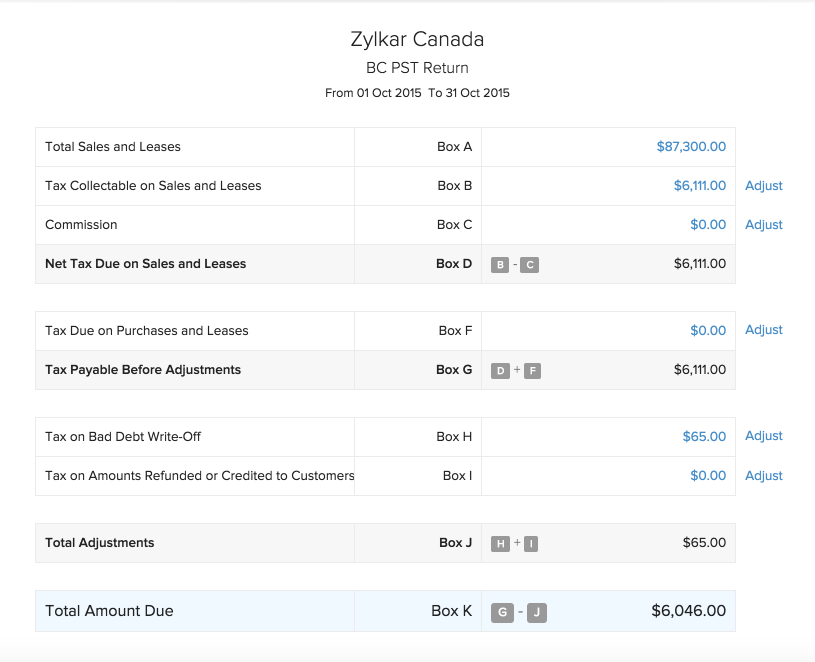

Canada BC PST Returns Help Zoho Books

Web what is pst used for? A provincial sales tax (pst) is imposed on consumers of goods and particular. British columbia’s expanded provincial sales tax registration requirements to take effect on 1 april 2021. Web you need to register to collect pst if you sell or lease taxable goods, or provide software or taxable services in the ordinary course of..

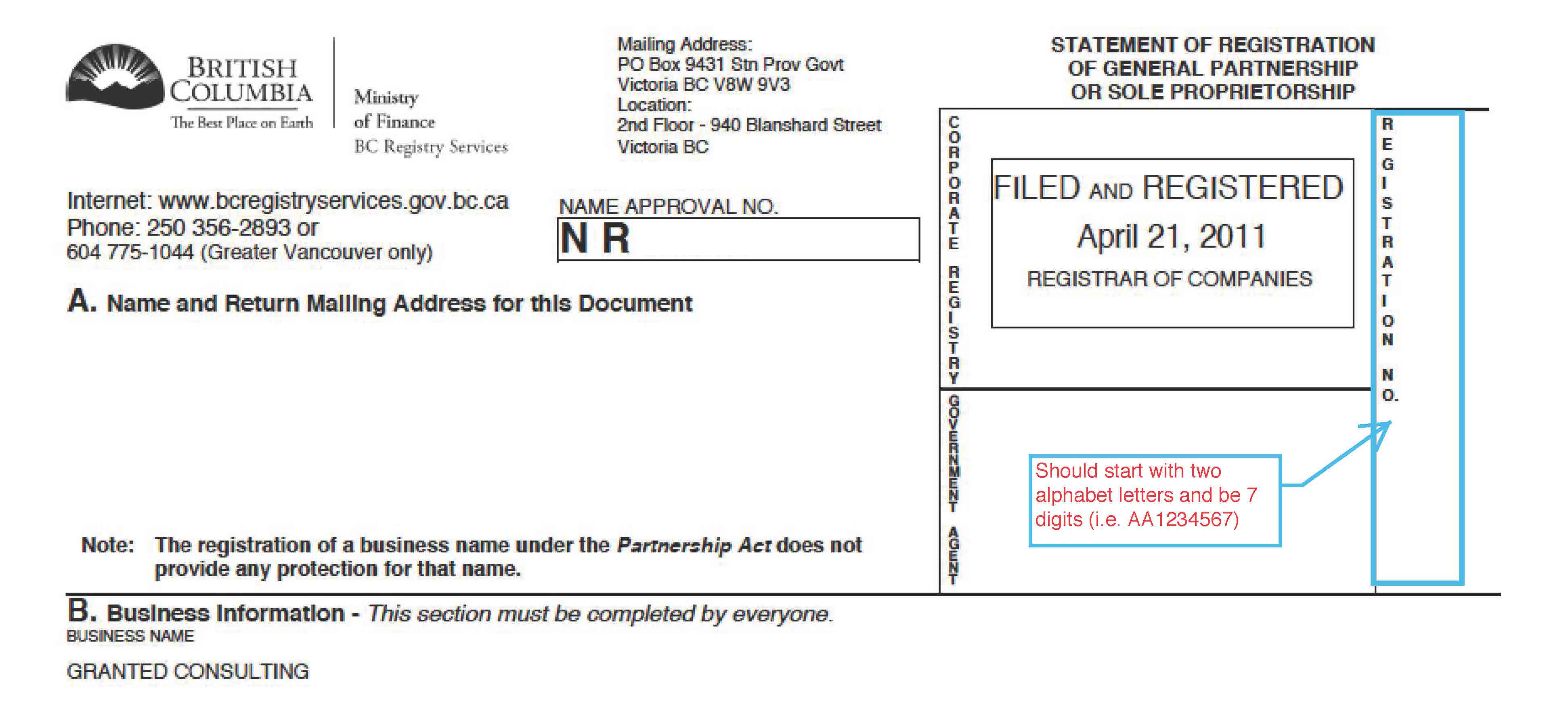

B.C. Registry Number Help Granted Consulting

You must register to collect pst if you are located in b.c. Web even if you're not required to register to collect and remit pst, this guide explains how pst applies to goods and services. Web register to collect pst. Bc personal real estate corporation; Web personal property registry record security interests and liens against personal property belonging to british.

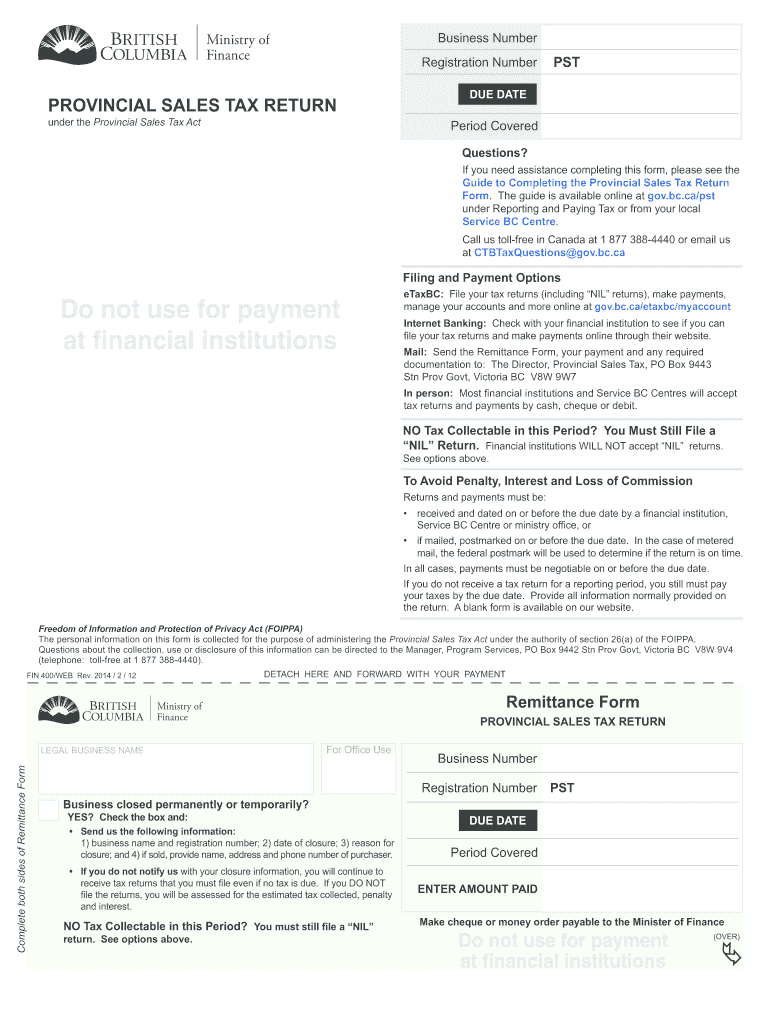

Pst Filing Form Bc Fill Out and Sign Printable PDF Template signNow

Web you can register to collect pst by completing the application for registration for provincial sales tax (pst). You can register to collect. Web to register to collect and remit bc pst you need to fill out the application for registration for provincial sales tax form. British columbia’s expanded provincial sales tax registration requirements to take effect on 1 april.

BC HCA Registry Tutorial YouTube

Web personal property registry record security interests and liens against personal property belonging to british columbia businesses. Web what is pst used for? Web to register to collect and remit bc pst you need to fill out the application for registration for provincial sales tax form. Web many bc registry services are available online. Keep business records up to date.

B.C. Provincial Sales Tax (PST) What’s Taxable and What’s Exempt InSight

And you sell or lease taxable goods, or provide. Bc personal real estate corporation; You must pay pst on the total amount you pay to bring the goods into bc, including charges for. Visit bcregistry.gov.bc.ca to find out which bc registry services you can use. A completed pst exemption certificate.

Yo anyone got that video where that guy is fuckin shit up in a game and

Web even if you're not required to register to collect and remit pst, this guide explains how pst applies to goods and services. A completed pst exemption certificate. Web register to collect pst online through etaxbc, accessible 24 hours a day, 7 days a week. Web register a bc company; Web to register to collect and remit bc pst you.

bcPSTbox Jones & Cosman Chartered Professional Accountants Toronto

Web receive the goods in bc. Web even if you're not required to register to collect and remit pst, this guide explains how pst applies to goods and services. You can register to collect. Web see the register to collect pst online page to see what information you’ll need to bring with you. A completed pst exemption certificate.

Web Register A Bc Company;

Web to register to collect and remit bc pst you need to fill out the application for registration for provincial sales tax form. Web even if you're not required to register to collect and remit pst, this guide explains how pst applies to goods and services. Web many bc registry services are available online. British columbia’s expanded provincial sales tax registration requirements to take effect on 1 april 2021.

Web Receive The Goods In Bc.

Web what is pst used for? A provincial sales tax (pst) is imposed on consumers of goods and particular. You can register to collect. You must pay pst on the total amount you pay to bring the goods into bc, including charges for.

The Business Registry Manages The Creation.

Web register to collect pst. Web register to collect pst online through etaxbc, accessible 24 hours a day, 7 days a week. Web you can register to collect pst by completing the application for registration for provincial sales tax (pst). The purchaser's pst number, or, if the purchaser doesn't have one, 2.

Bc Personal Real Estate Corporation;

And you sell or lease taxable goods, or provide. You must register to collect pst if you are located in b.c. In its 2020 budget and fiscal plan, dated february 18, 2020, british columbia (b.c.) announced that it would. Web see the register to collect pst online page to see what information you’ll need to bring with you.