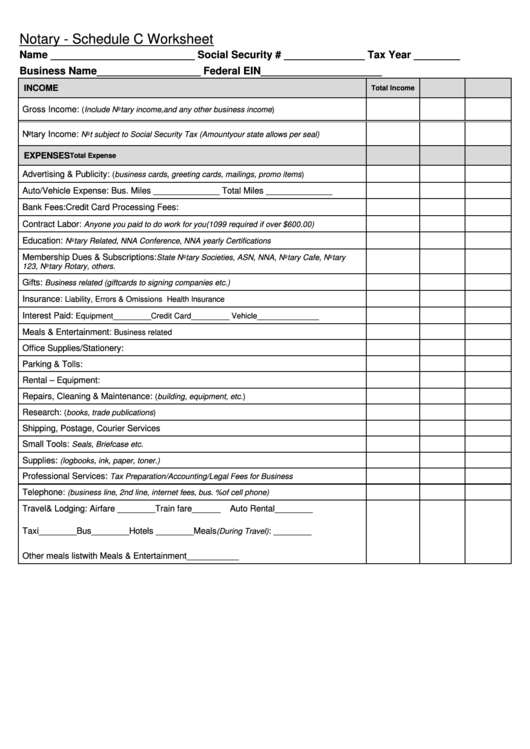

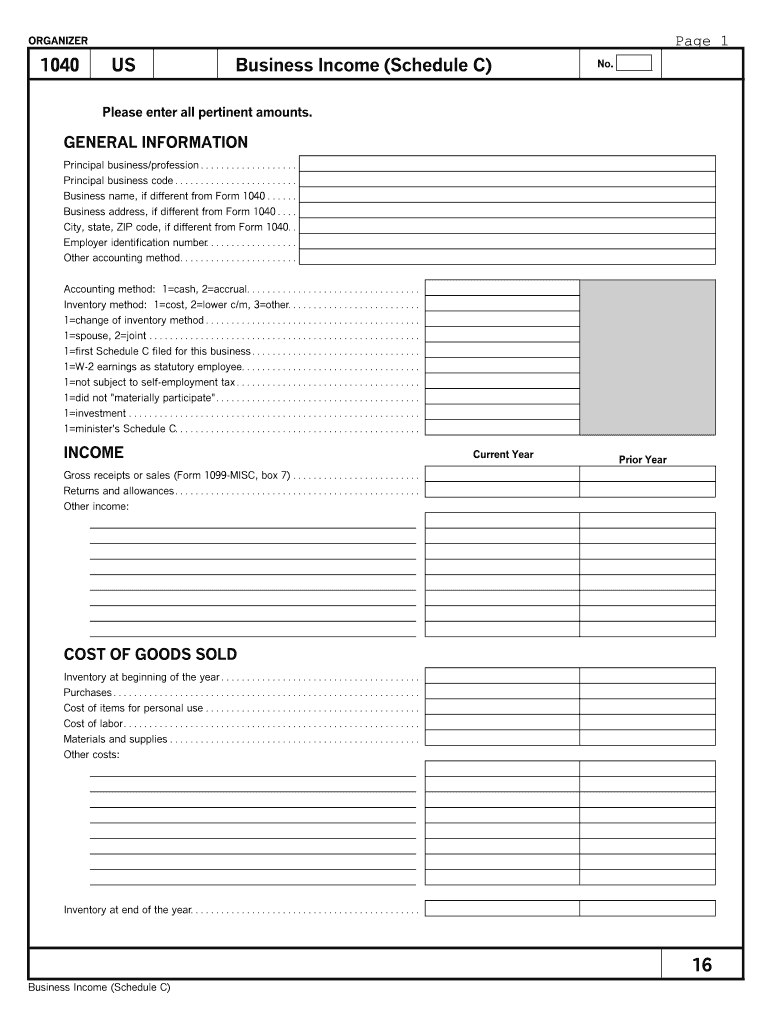

Printable Schedule C Worksheet

Printable Schedule C Worksheet - Web go to www.irs.gov/schedulec for instructions and the latest information. Square, paypal, etc.) expense category amount comments • inventory • net loss • employees/contractors • depreciation • pension and profit sharing • mortgage interest • business use of home Use separate sheet for each business. The law requires you to keep adequate records to complete your schedule c. Partnerships must generally file form 1065. Please review each line of this questionnaire and answer every question. Use a separate worksheet for each business owned/operated. Download the excel worksheet here. Partnerships must generally file form 1065.

Partnerships must generally file form 1065. Get out your shoebox of 2022 receipts and let’s get organized. Use separate sheet for each business. Web go to www.irs.gov/schedulec for instructions and the latest information. Web schedule c worksheet hickman & hickman, pllc. • inventory • net loss • employees/contractors • depreciation • pension and profit sharing • mortgage interest • business use of home Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. Web the best way to track income & expenses for tax form 1040. Use a separate worksheet for each business owned/operated. Please review each line of this questionnaire and answer every question.

Web the best way to track income & expenses for tax form 1040. Web go to www.irs.gov/schedulec for instructions and the latest information. • inventory • net loss • employees/contractors • depreciation • pension and profit sharing • mortgage interest • business use of home Partnerships must generally file form 1065. Square, paypal, etc.) expense category amount comments Please review each line of this questionnaire and answer every question. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)_____ address (if any) _____ is this your first year in business? Partnerships must generally file form 1065. The law requires you to keep adequate records to complete your schedule c. Get out your shoebox of 2022 receipts and let’s get organized.

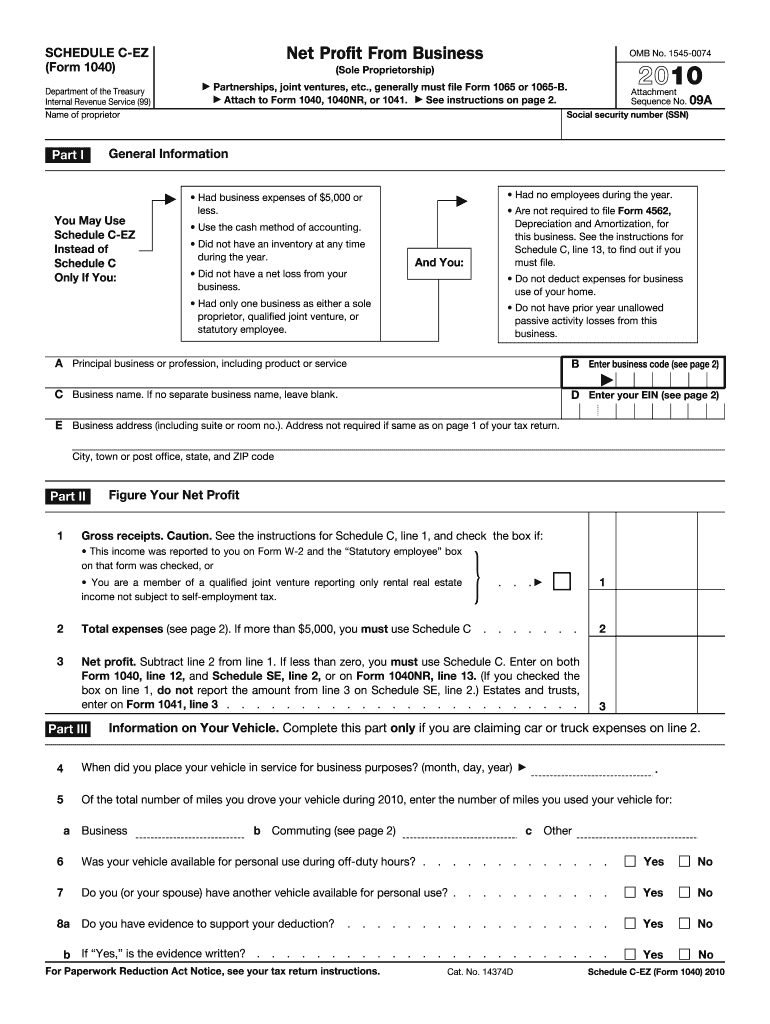

Schedule C Ez Form Fill Out and Sign Printable PDF Template signNow

Partnerships must generally file form 1065. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)_____ address (if any) _____ is this your first year in business? Use a separate worksheet for each business owned/operated. • inventory • net loss •.

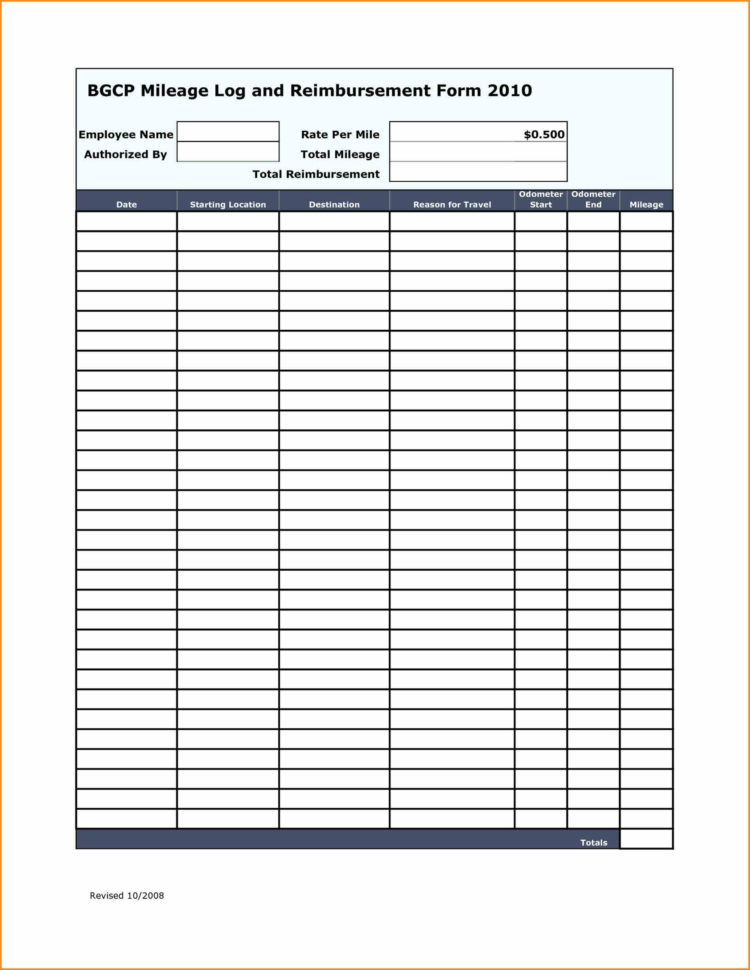

Schedule C Car And Truck Expenses Worksheet Awesome Driver —

Partnerships must generally file form 1065. • inventory • net loss • employees/contractors • depreciation • pension and profit sharing • mortgage interest • business use of home Web schedule c worksheet hickman & hickman, pllc. Use separate sheet for each business. Use a separate worksheet for each business owned/operated.

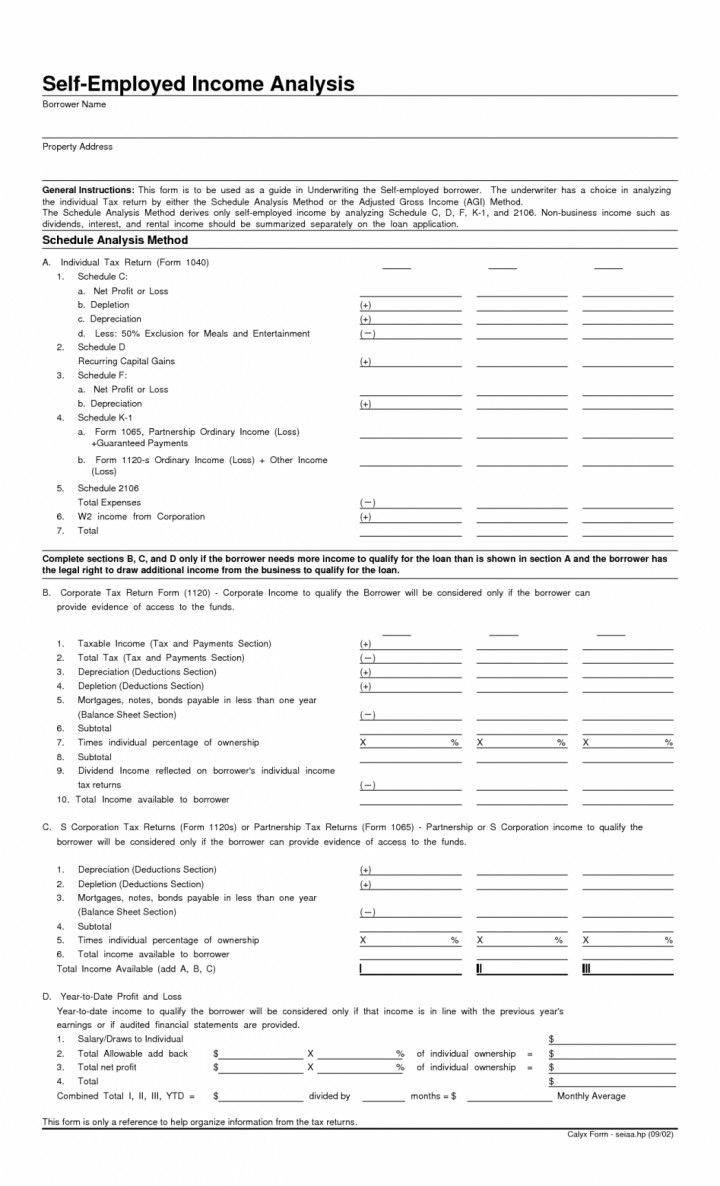

Schedule C Calculation Worksheet —

Web schedule c worksheet hickman & hickman, pllc. Web go to www.irs.gov/schedulec for instructions and the latest information. Please review each line of this questionnaire and answer every question. Square, paypal, etc.) expense category amount comments Use separate sheet for each business.

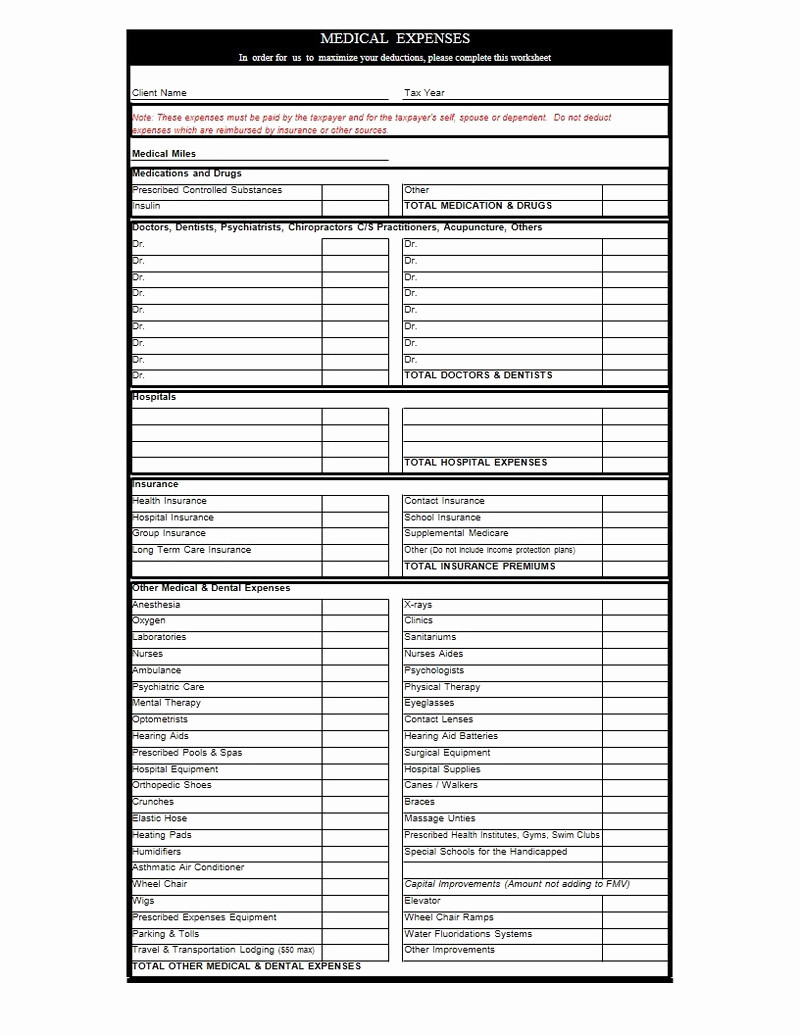

Schedule C Expenses Spreadsheet Of Schedule C Expenses —

Download the excel worksheet here. Partnerships must generally file form 1065. Please review each line of this questionnaire and answer every question. Use a separate worksheet for each business owned/operated. • inventory • net loss • employees/contractors • depreciation • pension and profit sharing • mortgage interest • business use of home

Printable Schedule C Form Fill Out and Sign Printable PDF Template

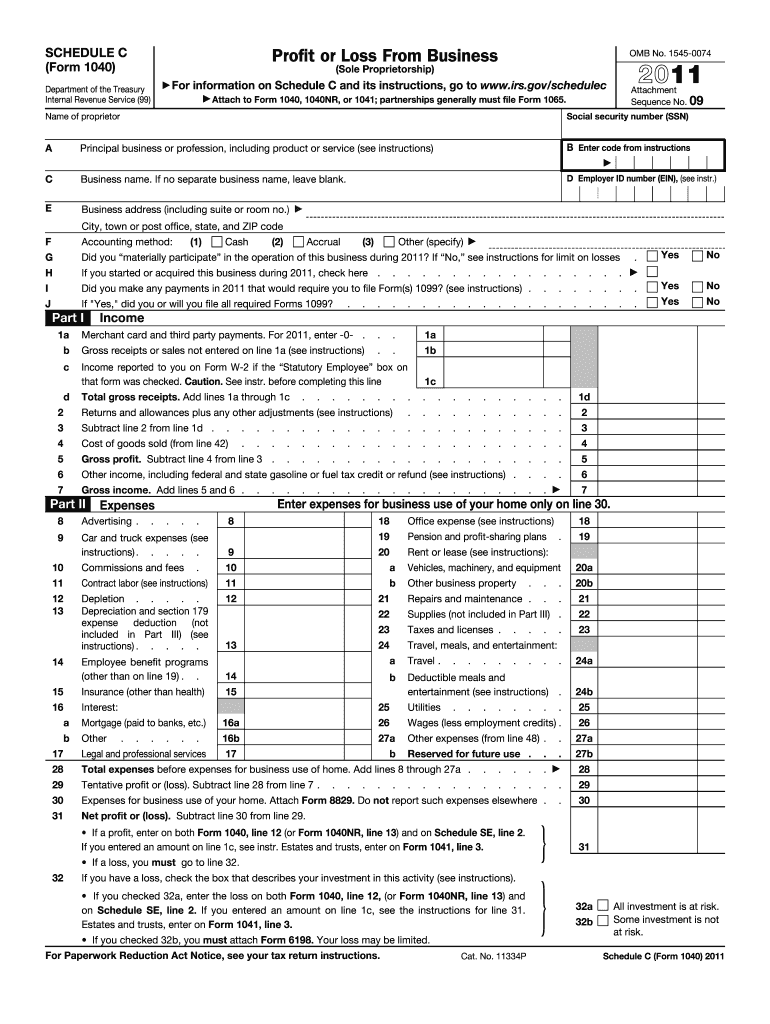

Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. Partnerships must generally file form 1065. Please review each line of this questionnaire and answer every question. Use separate sheet for each business. The law requires you to keep adequate.

Schedule C Form Fill Out and Sign Printable PDF Template signNow

Use a separate worksheet for each business owned/operated. Web schedule c worksheet hickman & hickman, pllc. Use separate sheet for each business. Web go to www.irs.gov/schedulec for instructions and the latest information. Please review each line of this questionnaire and answer every question.

Schedule C Expenses Spreadsheet Download Laobing Kaisuo —

Web schedule c worksheet hickman & hickman, pllc. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. The law requires you to keep adequate records to complete your schedule c. Partnerships must generally file form 1065. Web go to.

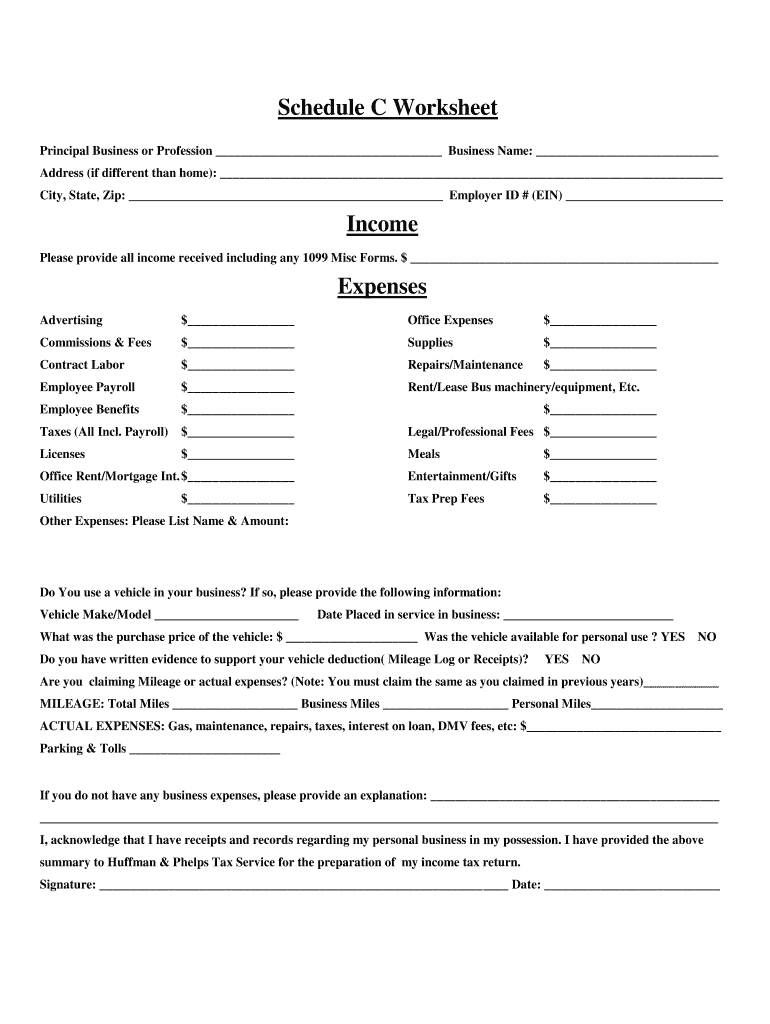

Schedule C Worksheet Form Fill Out and Sign Printable PDF Template

Web form 1040 schedule c (profit or loss from business) this questionnaire lists the types of records you need to send us to prove your schedule c income and expenses. Download the excel worksheet here. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s.

Who's required to fill out a Schedule C IRS form?

Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)_____ address (if any) _____ is this your first year in business? Partnerships must generally file form 1065. Web form 1040 schedule c (profit or loss from business) this questionnaire lists the.

Simplified Worksheet For Schedule C Schedule C Worksheet Printable Pdf

Web go to www.irs.gov/schedulec for instructions and the latest information. • inventory • net loss • employees/contractors • depreciation • pension and profit sharing • mortgage interest • business use of home Web the best way to track income & expenses for tax form 1040. Partnerships must generally file form 1065. Get out your shoebox of 2022 receipts and let’s.

Web Schedule C Worksheet Hickman & Hickman, Pllc.

Partnerships must generally file form 1065. Use a separate worksheet for each business owned/operated. Square, paypal, etc.) expense category amount comments Web the best way to track income & expenses for tax form 1040.

Please Review Each Line Of This Questionnaire And Answer Every Question.

• inventory • net loss • employees/contractors • depreciation • pension and profit sharing • mortgage interest • business use of home Web go to www.irs.gov/schedulec for instructions and the latest information. The law requires you to keep adequate records to complete your schedule c. Get out your shoebox of 2022 receipts and let’s get organized.

Web Form 1040 Schedule C (Profit Or Loss From Business) This Questionnaire Lists The Types Of Records You Need To Send Us To Prove Your Schedule C Income And Expenses.

Partnerships must generally file form 1065. Download the excel worksheet here. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)_____ address (if any) _____ is this your first year in business? Use separate sheet for each business.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)