Negative Goodwill On Balance Sheet

Negative Goodwill On Balance Sheet - Web negative goodwill (ngw) refers to a bargain purchase amount of money paid when a company acquires another company or its assets. Negative goodwill indicates that the selling party is. Alternatively, goodwill may be recorded as a contra. Income statement the company can directly add the negative goodwill as ‘gain on. Web reporting negative goodwill in the balance sheet and income statement if ngw is less than the market value of the acquired assets (excluding liabilities), the amount of the acquired assets. Web in the balance sheet of the selling company, goodwill is recorded as an asset, whereas negative goodwill is part of the liabilities since it reduces the valuation. Web as per both us gaap and ifrs, companies can report negative goodwill on the financial statements as follows:

Web negative goodwill (ngw) refers to a bargain purchase amount of money paid when a company acquires another company or its assets. Web in the balance sheet of the selling company, goodwill is recorded as an asset, whereas negative goodwill is part of the liabilities since it reduces the valuation. Alternatively, goodwill may be recorded as a contra. Web as per both us gaap and ifrs, companies can report negative goodwill on the financial statements as follows: Web reporting negative goodwill in the balance sheet and income statement if ngw is less than the market value of the acquired assets (excluding liabilities), the amount of the acquired assets. Income statement the company can directly add the negative goodwill as ‘gain on. Negative goodwill indicates that the selling party is.

Income statement the company can directly add the negative goodwill as ‘gain on. Web as per both us gaap and ifrs, companies can report negative goodwill on the financial statements as follows: Negative goodwill indicates that the selling party is. Web in the balance sheet of the selling company, goodwill is recorded as an asset, whereas negative goodwill is part of the liabilities since it reduces the valuation. Alternatively, goodwill may be recorded as a contra. Web reporting negative goodwill in the balance sheet and income statement if ngw is less than the market value of the acquired assets (excluding liabilities), the amount of the acquired assets. Web negative goodwill (ngw) refers to a bargain purchase amount of money paid when a company acquires another company or its assets.

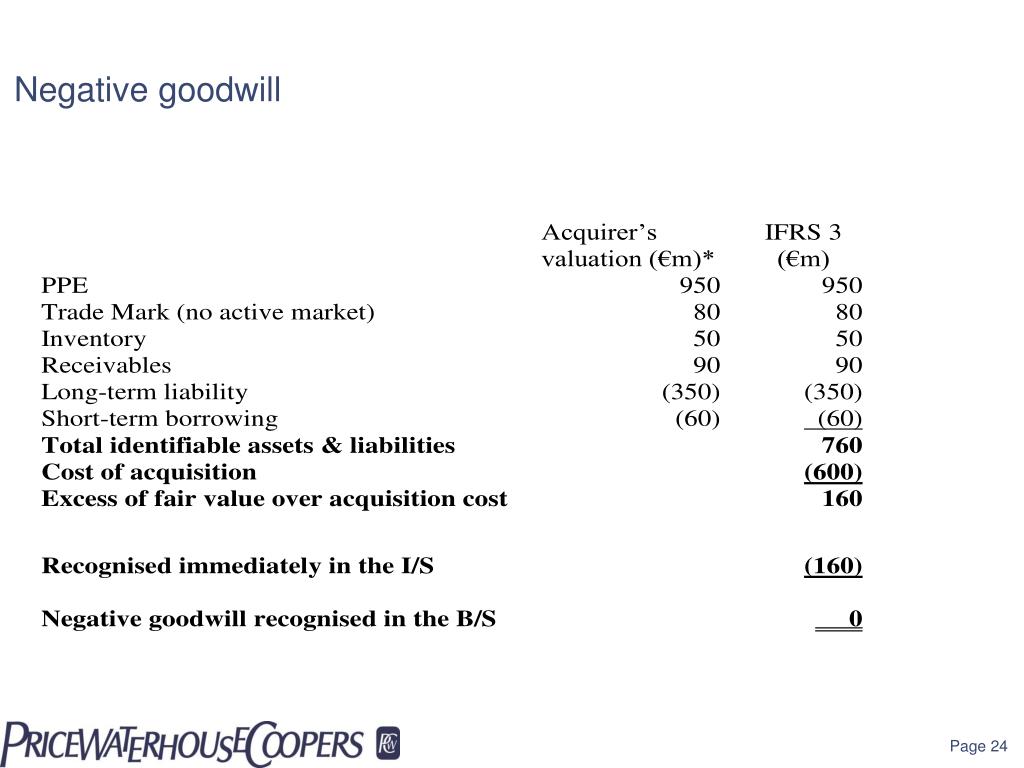

PPT IFRS 3 Business combinations PowerPoint Presentation, free

Web negative goodwill (ngw) refers to a bargain purchase amount of money paid when a company acquires another company or its assets. Alternatively, goodwill may be recorded as a contra. Income statement the company can directly add the negative goodwill as ‘gain on. Web reporting negative goodwill in the balance sheet and income statement if ngw is less than the.

How to Account for Negative Goodwill (with Pictures) wikiHow

Web in the balance sheet of the selling company, goodwill is recorded as an asset, whereas negative goodwill is part of the liabilities since it reduces the valuation. Web as per both us gaap and ifrs, companies can report negative goodwill on the financial statements as follows: Web reporting negative goodwill in the balance sheet and income statement if ngw.

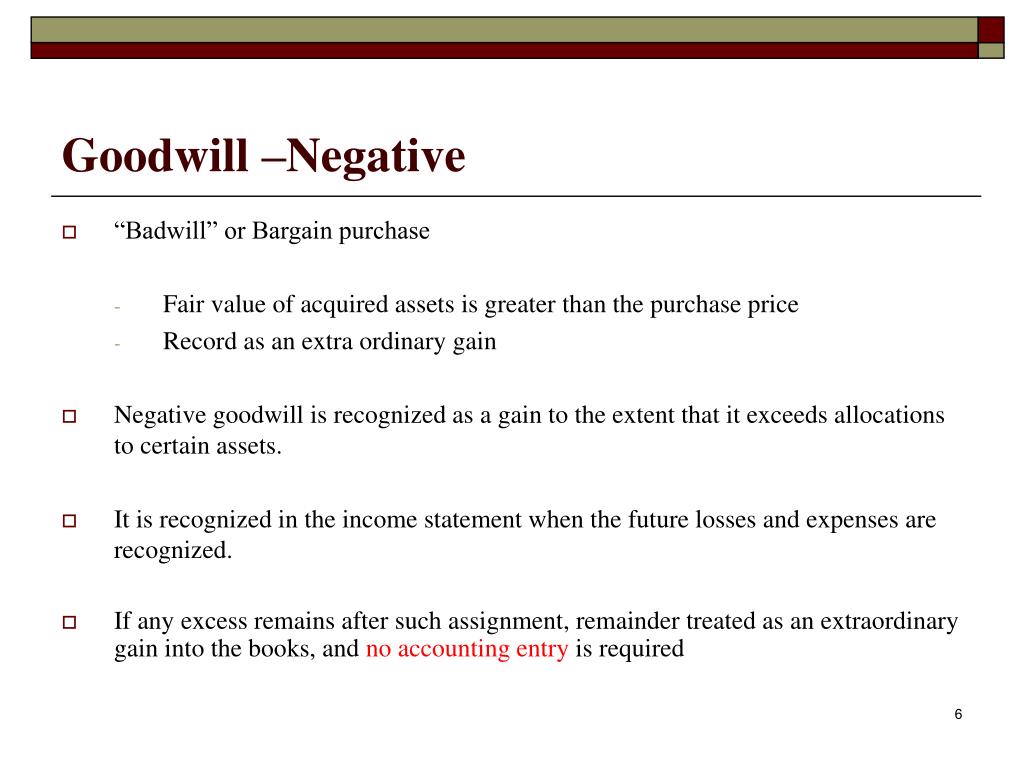

PPT “Goodwill Valuation” PowerPoint Presentation, free download ID

Web as per both us gaap and ifrs, companies can report negative goodwill on the financial statements as follows: Web reporting negative goodwill in the balance sheet and income statement if ngw is less than the market value of the acquired assets (excluding liabilities), the amount of the acquired assets. Income statement the company can directly add the negative goodwill.

How to Account for Negative Goodwill (with Pictures) wikiHow

Web in the balance sheet of the selling company, goodwill is recorded as an asset, whereas negative goodwill is part of the liabilities since it reduces the valuation. Alternatively, goodwill may be recorded as a contra. Negative goodwill indicates that the selling party is. Web as per both us gaap and ifrs, companies can report negative goodwill on the financial.

Goodwill in Finance Definition, Calculation, Formula

Negative goodwill indicates that the selling party is. Alternatively, goodwill may be recorded as a contra. Web as per both us gaap and ifrs, companies can report negative goodwill on the financial statements as follows: Income statement the company can directly add the negative goodwill as ‘gain on. Web in the balance sheet of the selling company, goodwill is recorded.

Negative Goodwill Negative Goodwill in the Balance Sheet

Web in the balance sheet of the selling company, goodwill is recorded as an asset, whereas negative goodwill is part of the liabilities since it reduces the valuation. Web negative goodwill (ngw) refers to a bargain purchase amount of money paid when a company acquires another company or its assets. Web as per both us gaap and ifrs, companies can.

Understanding Negative Balances in Your Financial Statements Fortiviti

Web as per both us gaap and ifrs, companies can report negative goodwill on the financial statements as follows: Income statement the company can directly add the negative goodwill as ‘gain on. Negative goodwill indicates that the selling party is. Alternatively, goodwill may be recorded as a contra. Web reporting negative goodwill in the balance sheet and income statement if.

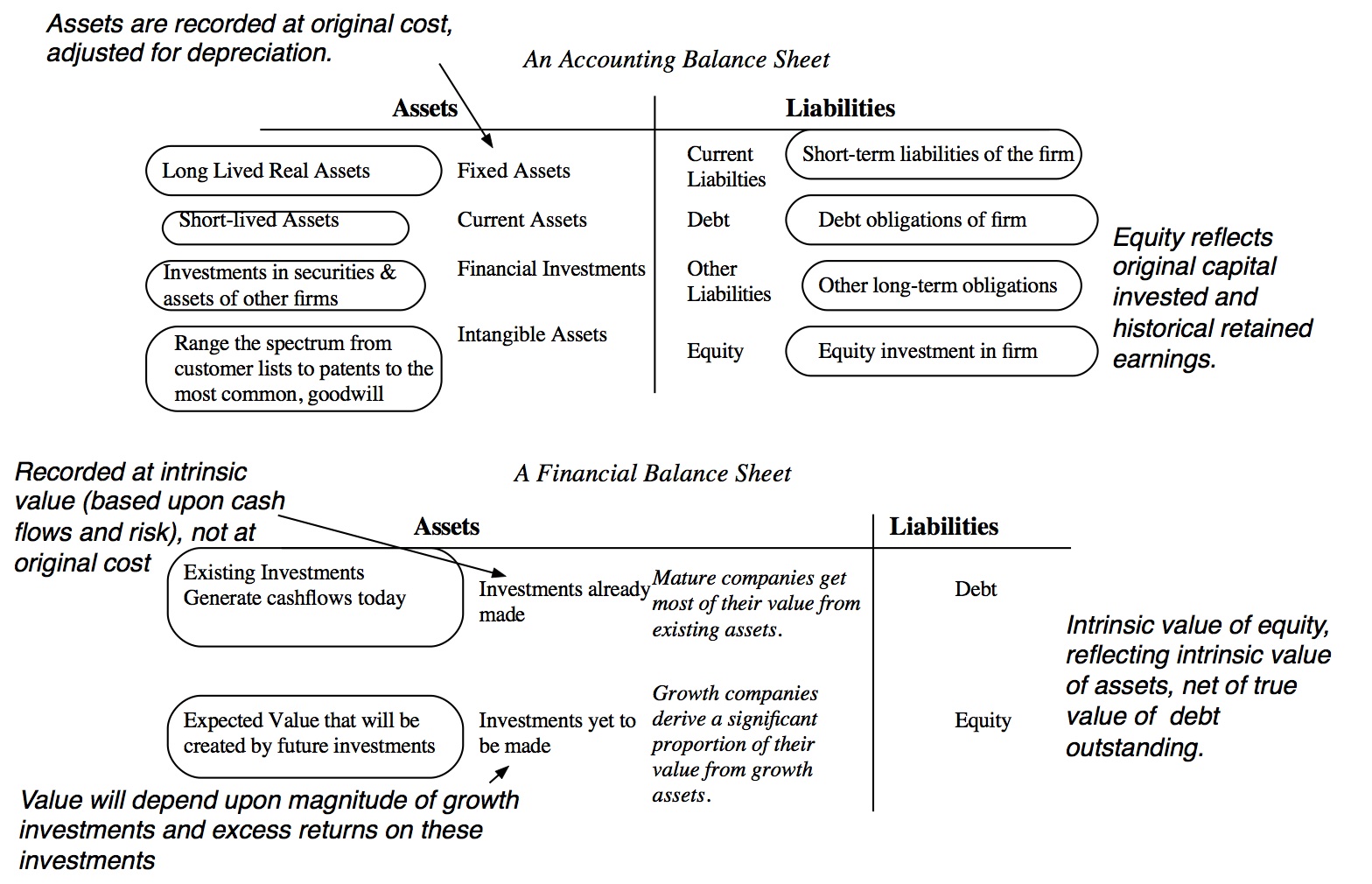

Musings on Markets Acquisition Accounting II Goodwill, more plug than

Alternatively, goodwill may be recorded as a contra. Web as per both us gaap and ifrs, companies can report negative goodwill on the financial statements as follows: Negative goodwill indicates that the selling party is. Web in the balance sheet of the selling company, goodwill is recorded as an asset, whereas negative goodwill is part of the liabilities since it.

Negative Goodwill (Definition, Examples) How to Interpret?

Income statement the company can directly add the negative goodwill as ‘gain on. Web in the balance sheet of the selling company, goodwill is recorded as an asset, whereas negative goodwill is part of the liabilities since it reduces the valuation. Web reporting negative goodwill in the balance sheet and income statement if ngw is less than the market value.

Negative Goodwill (NGW) Definition, Examples, and Accounting

Web reporting negative goodwill in the balance sheet and income statement if ngw is less than the market value of the acquired assets (excluding liabilities), the amount of the acquired assets. Alternatively, goodwill may be recorded as a contra. Web negative goodwill (ngw) refers to a bargain purchase amount of money paid when a company acquires another company or its.

Web In The Balance Sheet Of The Selling Company, Goodwill Is Recorded As An Asset, Whereas Negative Goodwill Is Part Of The Liabilities Since It Reduces The Valuation.

Alternatively, goodwill may be recorded as a contra. Web reporting negative goodwill in the balance sheet and income statement if ngw is less than the market value of the acquired assets (excluding liabilities), the amount of the acquired assets. Web as per both us gaap and ifrs, companies can report negative goodwill on the financial statements as follows: Web negative goodwill (ngw) refers to a bargain purchase amount of money paid when a company acquires another company or its assets.

Income Statement The Company Can Directly Add The Negative Goodwill As ‘Gain On.

Negative goodwill indicates that the selling party is.

:max_bytes(150000):strip_icc()/NegativeGoodwillNGW_v1-72f2738e9d1646e4b33d9d14c79614c6.jpg)