Does Depreciation Expense Go On The Balance Sheet

Does Depreciation Expense Go On The Balance Sheet - Web for income statements, depreciation is listed as an expense. Accumulated depreciation is not recorded separately on the balance sheet. On the other hand, when it’s listed on the balance sheet, it accounts for total. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web depreciation on your balance sheet. The balance sheet of a business shows the value of the assets of the business against the value of the liabilities and owner's equity or retained earnings. Web depreciation expense is recorded on the income statement as an expense or debit, reducing net income. Accumulated depreciation is listed on the balance sheet. It is reported on the income statement along with other normal business expenses. The cost for each year you own the asset becomes a business expense for that.

It accounts for depreciation charged to expense for the income reporting period. Accumulated depreciation is not recorded separately on the balance sheet. Web for income statements, depreciation is listed as an expense. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. On the other hand, when it’s listed on the balance sheet, it accounts for total. Web depreciation on your balance sheet. Depreciation expense is not a current asset; Web depreciation expense is recorded on the income statement as an expense or debit, reducing net income. Accumulated depreciation is listed on the balance sheet. The cost for each year you own the asset becomes a business expense for that.

It accounts for depreciation charged to expense for the income reporting period. Accumulated depreciation is not recorded separately on the balance sheet. On the other hand, when it’s listed on the balance sheet, it accounts for total. Accumulated depreciation is listed on the balance sheet. The balance sheet of a business shows the value of the assets of the business against the value of the liabilities and owner's equity or retained earnings. Web depreciation on your balance sheet. The cost for each year you own the asset becomes a business expense for that. Web depreciation expense is recorded on the income statement as an expense or debit, reducing net income. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web for income statements, depreciation is listed as an expense.

Depreciation Turns Capital Expenditures into Expenses Over Time

It is reported on the income statement along with other normal business expenses. On the other hand, when it’s listed on the balance sheet, it accounts for total. The balance sheet of a business shows the value of the assets of the business against the value of the liabilities and owner's equity or retained earnings. Accumulated depreciation is not recorded.

Depreciation

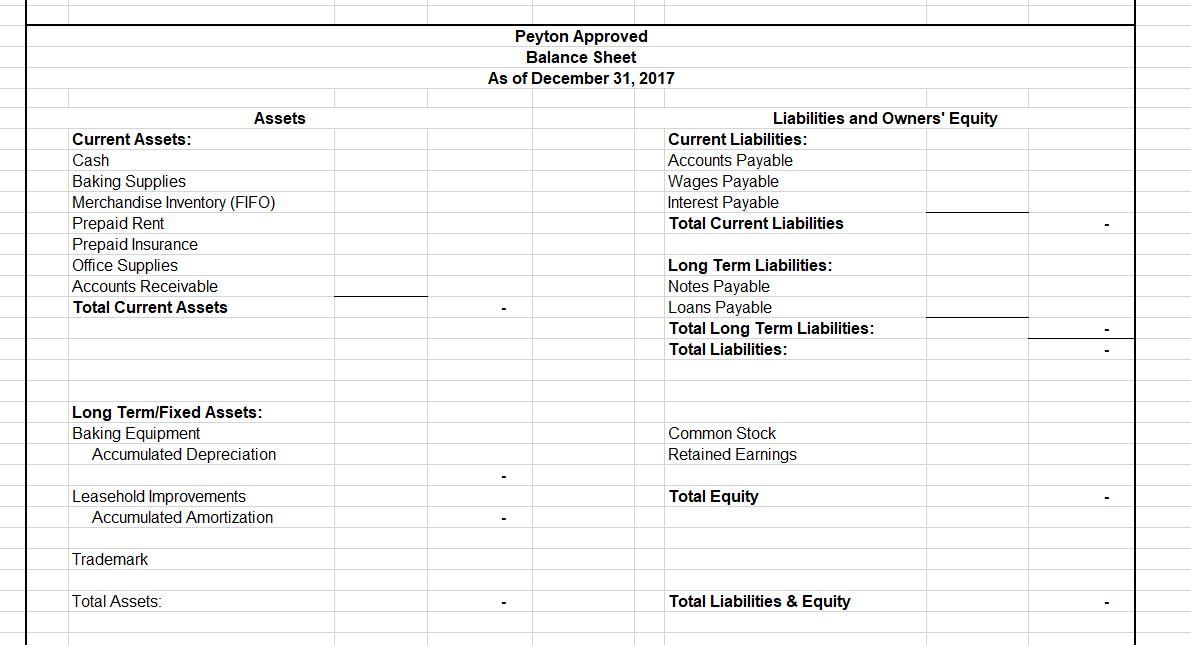

Accumulated depreciation is not recorded separately on the balance sheet. Web depreciation on your balance sheet. It accounts for depreciation charged to expense for the income reporting period. Accumulated depreciation is listed on the balance sheet. The balance sheet of a business shows the value of the assets of the business against the value of the liabilities and owner's equity.

Solved Please help with these tables below. In your final

Depreciation expense is not a current asset; Web depreciation on your balance sheet. Accumulated depreciation is listed on the balance sheet. It is reported on the income statement along with other normal business expenses. The cost for each year you own the asset becomes a business expense for that.

😍 State the formula for the accounting equation. What Is the Accounting

It accounts for depreciation charged to expense for the income reporting period. The balance sheet of a business shows the value of the assets of the business against the value of the liabilities and owner's equity or retained earnings. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over.

Solved Excluding accumulated depreciation, determine whether

Web depreciation on your balance sheet. Web depreciation expense is recorded on the income statement as an expense or debit, reducing net income. Web for income statements, depreciation is listed as an expense. Accumulated depreciation is not recorded separately on the balance sheet. It is reported on the income statement along with other normal business expenses.

How To Calculate Depreciation Cost Of Vehicle Haiper

Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. It is reported on the income statement along with other normal business expenses. Accumulated depreciation is listed on the balance sheet. On the other hand, when it’s listed on the balance sheet, it accounts for total. It accounts.

Raise yourself courage zero asset depreciation table Adolescent Brim Accord

The balance sheet of a business shows the value of the assets of the business against the value of the liabilities and owner's equity or retained earnings. It accounts for depreciation charged to expense for the income reporting period. Accumulated depreciation is not recorded separately on the balance sheet. Depreciation expense is not a current asset; Accumulated depreciation is listed.

What is Accumulated Depreciation? Formula + Calculator

Accumulated depreciation is listed on the balance sheet. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. It is reported on the income statement along with other normal business expenses. Accumulated depreciation is not recorded separately on the balance sheet. Web depreciation expense is recorded on the.

Solved STATEMENT Sales Cost of goods sold

Web for income statements, depreciation is listed as an expense. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web depreciation on your balance sheet. The cost for each year you own the asset becomes a business expense for that. Accumulated depreciation is not recorded separately on.

Pourquoi l'amortissement cumulé estil un solde créditeur

Accumulated depreciation is listed on the balance sheet. Web depreciation on your balance sheet. On the other hand, when it’s listed on the balance sheet, it accounts for total. It is reported on the income statement along with other normal business expenses. The balance sheet of a business shows the value of the assets of the business against the value.

It Accounts For Depreciation Charged To Expense For The Income Reporting Period.

Web depreciation on your balance sheet. Web for income statements, depreciation is listed as an expense. Depreciation expense is not a current asset; Web depreciation expense is recorded on the income statement as an expense or debit, reducing net income.

The Balance Sheet Of A Business Shows The Value Of The Assets Of The Business Against The Value Of The Liabilities And Owner's Equity Or Retained Earnings.

The cost for each year you own the asset becomes a business expense for that. On the other hand, when it’s listed on the balance sheet, it accounts for total. Accumulated depreciation is listed on the balance sheet. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time.

Accumulated Depreciation Is Not Recorded Separately On The Balance Sheet.

It is reported on the income statement along with other normal business expenses.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)