Does Accounts Receivable Go On The Balance Sheet

Does Accounts Receivable Go On The Balance Sheet - Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Web until the manufacturer issues the payment to complete the invoice, the accounts receivable remains on the balance sheet. Web the balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’. Accounts receivable are created when a company lets a buyer. Web accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short term. If a company has delivered products or services but not yet received. What is the journal entry for accounts receivable? Web investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable assurance of being paid by its customers at a defined.

What is the journal entry for accounts receivable? Web accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short term. Web until the manufacturer issues the payment to complete the invoice, the accounts receivable remains on the balance sheet. Accounts receivable are created when a company lets a buyer. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Web the balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’. If a company has delivered products or services but not yet received. Web investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable assurance of being paid by its customers at a defined.

What is the journal entry for accounts receivable? Web accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short term. If a company has delivered products or services but not yet received. Accounts receivable are created when a company lets a buyer. Web investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable assurance of being paid by its customers at a defined. Web the balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Web until the manufacturer issues the payment to complete the invoice, the accounts receivable remains on the balance sheet.

How do accounts payable show on the balance sheet? شبکه اطلاع رسانی

Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. What is the journal entry for accounts receivable? Web investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable assurance of being paid by its customers at a defined. Web accounts receivable (ar).

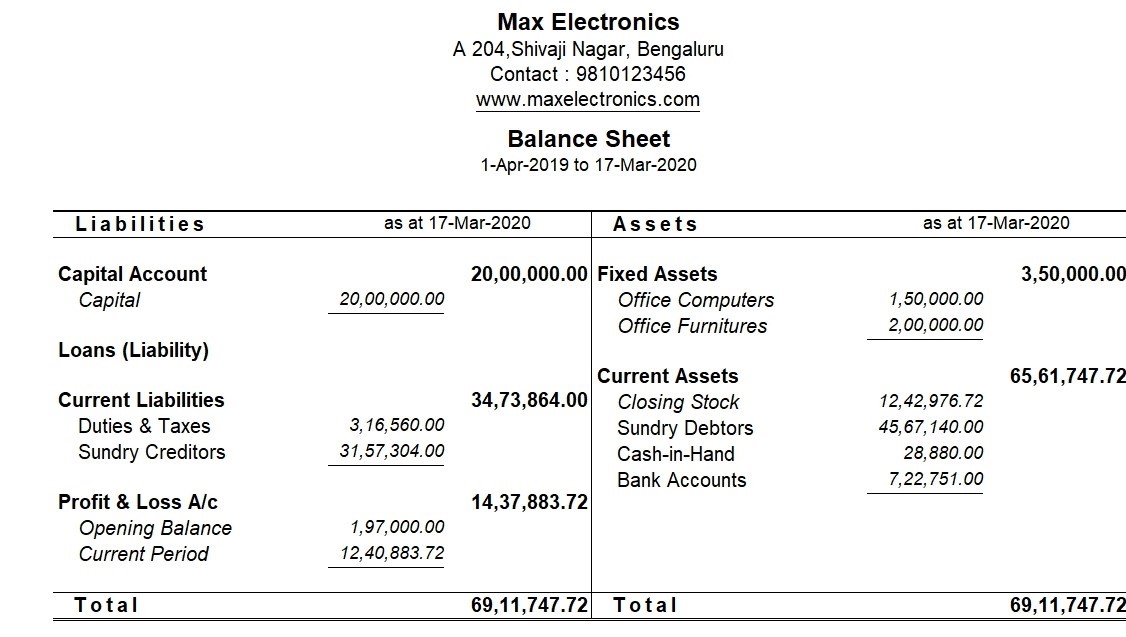

Consolidated Financial Statements Definition & Examples Tally Solutions

If a company has delivered products or services but not yet received. Web the balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’. Web until the manufacturer issues the payment to complete the invoice, the accounts receivable remains on the balance sheet. Web investors should.

Notes Receivable Definition Accounting

Web investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable assurance of being paid by its customers at a defined. Web the balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’. What is the journal.

Accounts Receivable (AR) What They Are and How to Interpret Pareto Labs

Accounts receivable are created when a company lets a buyer. Web the balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Web investors should interpret accounts receivable.

Accounts Receivable on the Balance Sheet Accounting Education

Web accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short term. Web until the manufacturer issues the payment to complete the invoice, the accounts receivable remains on the balance sheet. Web the balance sheet is just a more detailed version of the fundamental accounting equation—also known as the.

Solved Balance Sheet 2009 2008 Cash Accounts receivable

If a company has delivered products or services but not yet received. Web the balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’. Web accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short.

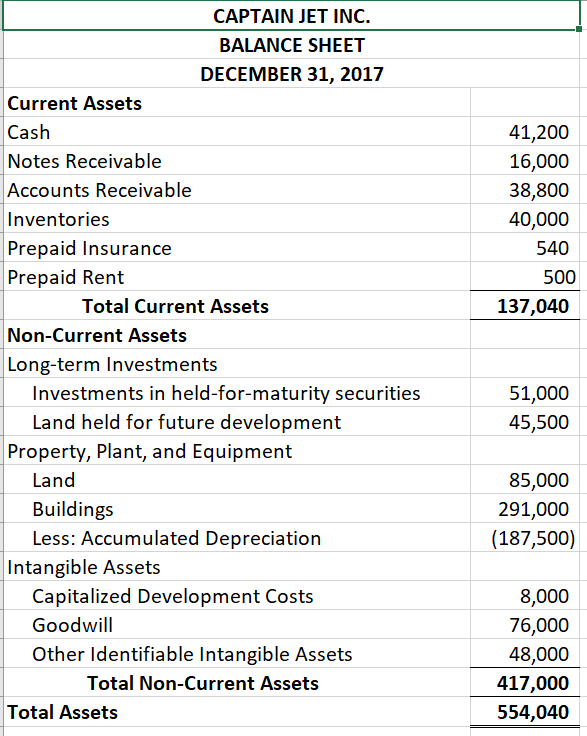

Solved CAPTAIN JET INC. BALANCE SHEET DECEMBER 31, 2017

Web until the manufacturer issues the payment to complete the invoice, the accounts receivable remains on the balance sheet. What is the journal entry for accounts receivable? Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. If a company has delivered products or services but not yet received. Accounts receivable are.

Accounts receivable BDC.ca

If a company has delivered products or services but not yet received. Web until the manufacturer issues the payment to complete the invoice, the accounts receivable remains on the balance sheet. Web investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable assurance of being paid by its customers at a.

Accounts Receivable on the Balance Sheet

What is the journal entry for accounts receivable? Web investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable assurance of being paid by its customers at a defined. Web the balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes.

The Importance of an Accurate Balance Sheet Basis 365 Accounting

Accounts receivable are created when a company lets a buyer. What is the journal entry for accounts receivable? Web until the manufacturer issues the payment to complete the invoice, the accounts receivable remains on the balance sheet. Web accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short term..

Accounts Receivable Are Created When A Company Lets A Buyer.

Web investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable assurance of being paid by its customers at a defined. Web the balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’. What is the journal entry for accounts receivable? Web until the manufacturer issues the payment to complete the invoice, the accounts receivable remains on the balance sheet.

Web Accounts Receivable, Sometimes Shortened To Receivables Or A/R, Is Money Owed To A Company By Its Customers.

If a company has delivered products or services but not yet received. Web accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short term.

:max_bytes(150000):strip_icc()/accounts-receivables-on-the-balance-sheet-357263-final-911167a5515b4facb2d39d25e4e5bf3d.jpg)