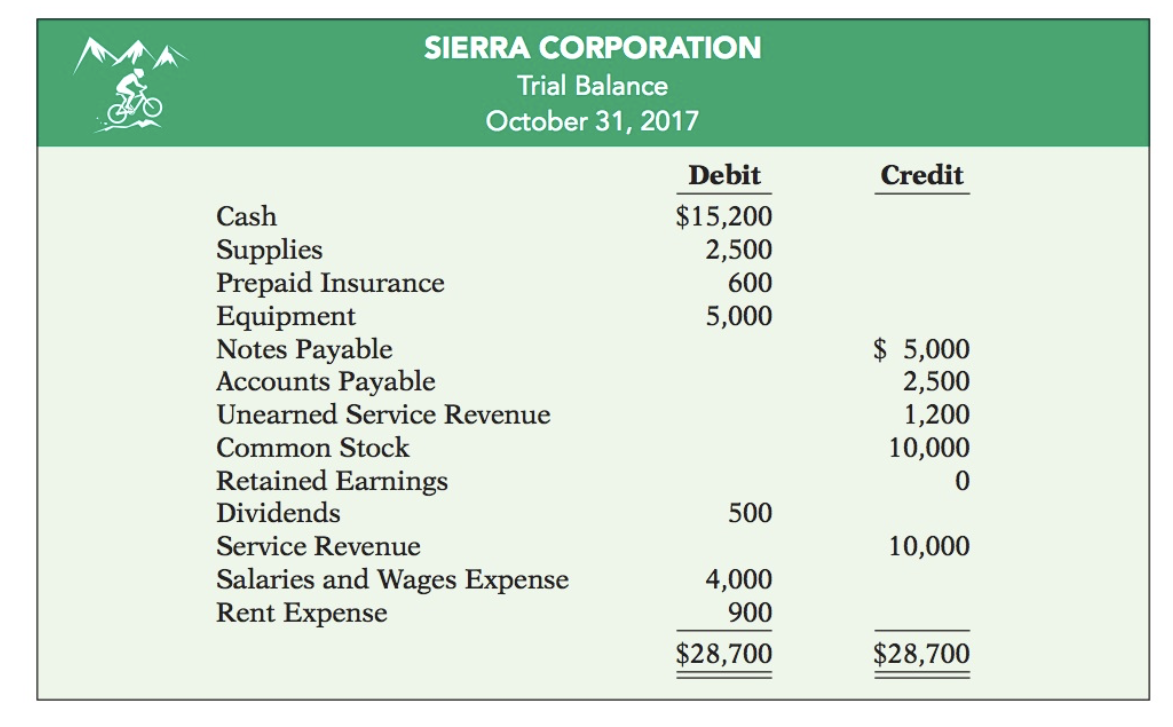

Accrued Expenses Are Ordinarily Reported On The Balance Sheet As

Accrued Expenses Are Ordinarily Reported On The Balance Sheet As - Web accrued expenses = $12m — decline by 0.5% as percentage of opex each year; Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. Web an accrual is an expense that has been recognized in the current period for which a supplier invoice has not yet been received, or revenue that has not yet been billed. When an accrual is created, it is. Accrued expenses % of opex (year 0) = $12m / $80m = 15.0%; An accrued expense can be an. In year 0, our historical period, we can calculate the driver as: As a result, liability for these expenditures is created and recorded as accrued liabilities (short term) on the. Accrued expenses haven’t yet been paid, they’re considered an added liability on the balance sheet. Accrued expenses and prepaid expenses are opposites.

Web accrued expenses are expenses incurred and for which the payment has not yet been made. As a result, liability for these expenditures is created and recorded as accrued liabilities (short term) on the. Accrued expenses haven’t yet been paid, they’re considered an added liability on the balance sheet. In year 0, our historical period, we can calculate the driver as: Web accrued expenses = $12m — decline by 0.5% as percentage of opex each year; Accrued expenses % of opex (year 0) = $12m / $80m = 15.0%; An accrued expense can be an. When an accrual is created, it is. Accrued expenses and prepaid expenses are opposites. Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities.

Accrued expenses haven’t yet been paid, they’re considered an added liability on the balance sheet. Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. As a result, liability for these expenditures is created and recorded as accrued liabilities (short term) on the. Web accrued expenses are expenses incurred and for which the payment has not yet been made. Web an accrual is an expense that has been recognized in the current period for which a supplier invoice has not yet been received, or revenue that has not yet been billed. In year 0, our historical period, we can calculate the driver as: When an accrual is created, it is. Accrued expenses % of opex (year 0) = $12m / $80m = 15.0%; An accrued expense can be an. Accrued expenses and prepaid expenses are opposites.

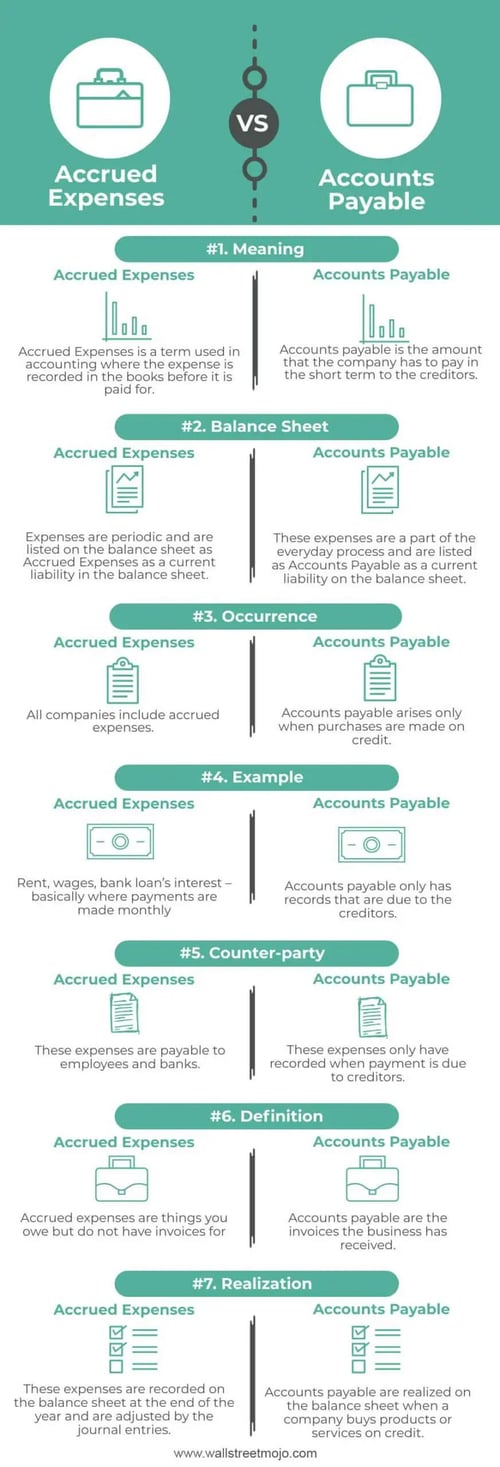

Accrued Expenses vs Accounts Payable Head to Head Difference Accounts

Accrued expenses and prepaid expenses are opposites. An accrued expense can be an. Web accrued expenses are expenses incurred and for which the payment has not yet been made. Accrued expenses % of opex (year 0) = $12m / $80m = 15.0%; Web an accrual is an expense that has been recognized in the current period for which a supplier.

Prepaid Rent Journal Entry slide share

Web accrued expenses = $12m — decline by 0.5% as percentage of opex each year; Web accrued expenses are expenses incurred and for which the payment has not yet been made. Accrued expenses and prepaid expenses are opposites. An accrued expense can be an. Web an accrual is an expense that has been recognized in the current period for which.

Prepaid expenses balance sheet laderfivestar

In year 0, our historical period, we can calculate the driver as: An accrued expense can be an. Accrued expenses haven’t yet been paid, they’re considered an added liability on the balance sheet. Web accrued expenses are expenses incurred and for which the payment has not yet been made. When an accrual is created, it is.

Accrued Expenses Definition + Balance Sheet Example

Accrued expenses haven’t yet been paid, they’re considered an added liability on the balance sheet. When an accrual is created, it is. An accrued expense can be an. Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. Web accrued expenses = $12m — decline by.

Difference Between Accrued Expense and Accounts Payable

Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. Accrued expenses and prepaid expenses are opposites. Web accrued expenses = $12m — decline by 0.5% as percentage of opex each year; Web an accrual is an expense that has been recognized in the current period.

Accrued Expense vs. Accounts Payable, Differences + Examples

Web accrued expenses = $12m — decline by 0.5% as percentage of opex each year; Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. Web accrued expenses are expenses incurred and for which the payment has not yet been made. Accrued expenses haven’t yet been.

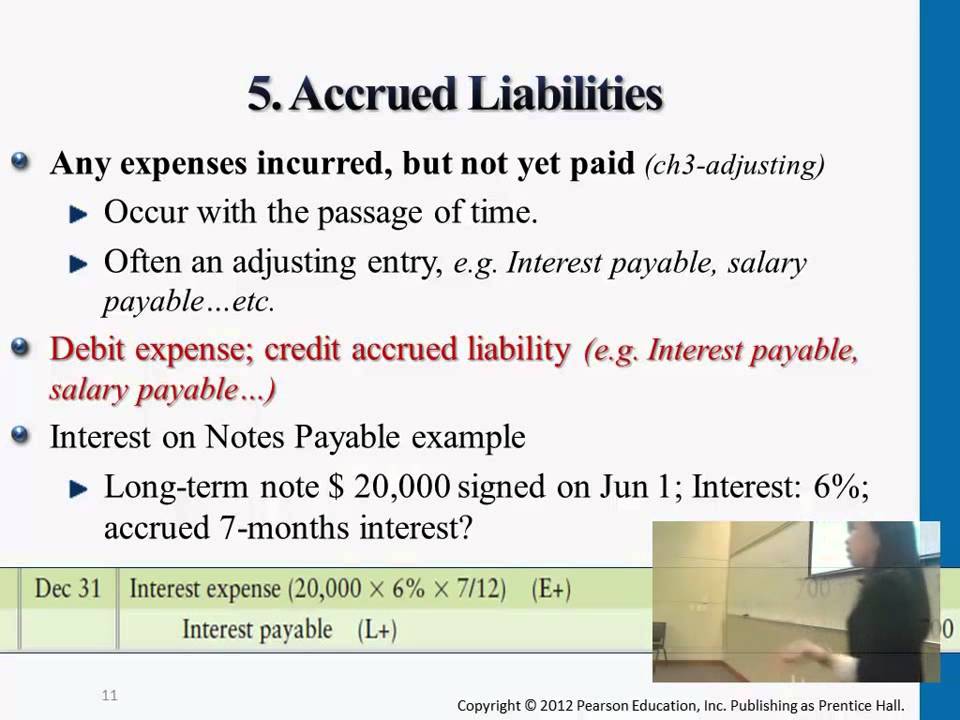

Accrual Of Wages Expense Balance Sheet PATCHED

Web accrued expenses are expenses incurred and for which the payment has not yet been made. Web accrued expenses = $12m — decline by 0.5% as percentage of opex each year; As a result, liability for these expenditures is created and recorded as accrued liabilities (short term) on the. Accrued expenses haven’t yet been paid, they’re considered an added liability.

Accrued expenses — AccountingTools India Dictionary

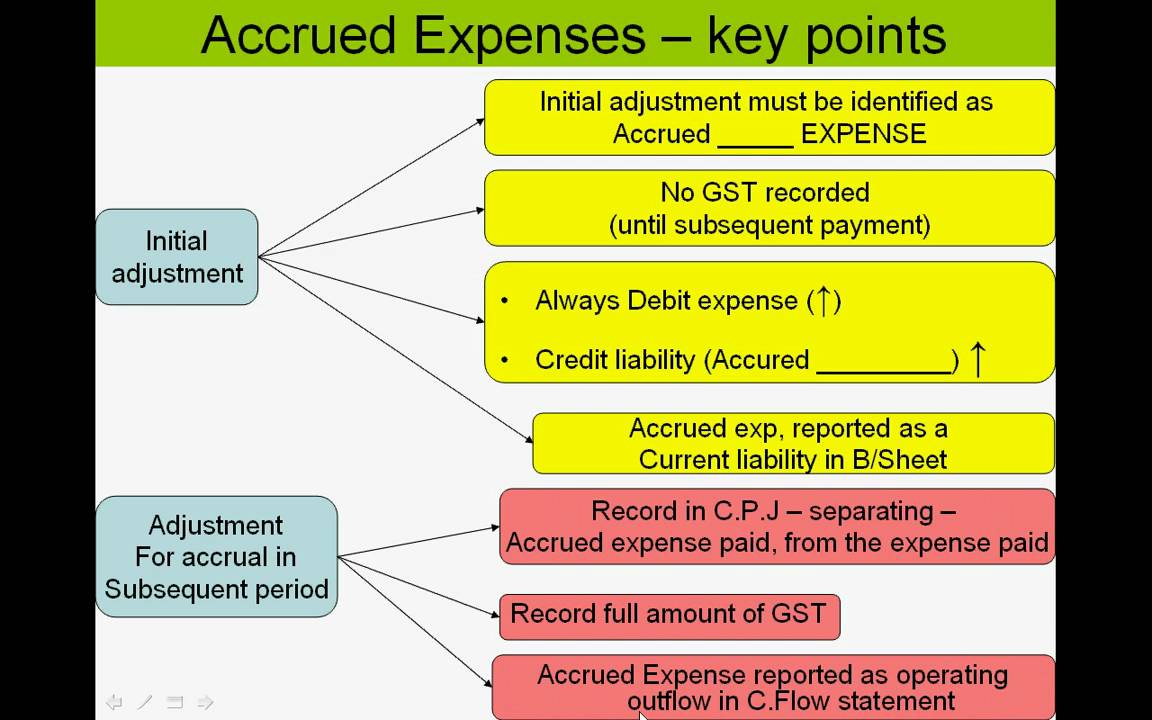

Accrued expenses % of opex (year 0) = $12m / $80m = 15.0%; Web accrued expenses = $12m — decline by 0.5% as percentage of opex each year; In year 0, our historical period, we can calculate the driver as: Web an accrual is an expense that has been recognized in the current period for which a supplier invoice has.

Unit 3 VCE Accounting Accrued Expenses YouTube

Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. Web an accrual is an expense that has been recognized in the current period for which a supplier invoice has not yet been received, or revenue that has not yet been billed. When an accrual is.

Solved I. Accrued expenses are ordinarily reported on the

Web accrued expenses are expenses incurred and for which the payment has not yet been made. Web accrued expenses = $12m — decline by 0.5% as percentage of opex each year; Web an accrual is an expense that has been recognized in the current period for which a supplier invoice has not yet been received, or revenue that has not.

Accrued Expenses % Of Opex (Year 0) = $12M / $80M = 15.0%;

Accrued expenses and prepaid expenses are opposites. Web accrued expenses = $12m — decline by 0.5% as percentage of opex each year; Web an accrual is an expense that has been recognized in the current period for which a supplier invoice has not yet been received, or revenue that has not yet been billed. As a result, liability for these expenditures is created and recorded as accrued liabilities (short term) on the.

An Accrued Expense Can Be An.

Web accrued expenses are expenses incurred and for which the payment has not yet been made. In year 0, our historical period, we can calculate the driver as: Web since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities. When an accrual is created, it is.