1099 Nec Form 2020 Printable

1099 Nec Form 2020 Printable - Brand new for 2020 is the 1099 nec form. This article will provide you with key information and guide you through the. 01 fill and edit template. See part o in the. The payer and the receiver should point their names, addresses, and taxpayers. Choose a previous version to file for the current tax year; If you have made a payment of. Get ready for this year's tax season quickly and safely with pdffiller! Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact. Pricing starts as low as $2.75/form.

See part o in the. Brand new for 2020 is the 1099 nec form. If you have made a payment of. Web moreover, you're still unable to print the forms for 2023 at the end of the year since your and you're unable to receive the latest critical security patches and product. The payer and the receiver should point their names, addresses, and taxpayers. Web print and file a form 1096 downloaded from this website; Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact. Get ready for this year's tax season quickly and safely with pdffiller! This article will provide you with key information and guide you through the. Web quick & secure online filing.

Pricing starts as low as $2.75/form. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Web quick & secure online filing. 03 export or print immediately. Web moreover, you're still unable to print the forms for 2023 at the end of the year since your and you're unable to receive the latest critical security patches and product. Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact. This form will be used to file next year's taxes. 01 fill and edit template. The payer and the receiver should point their names, addresses, and taxpayers. You can expect to receive this new form from a business that paid you $600 or more for nonemployee compensation in tax year 2020 or.

How to File Your Taxes if You Received a Form 1099NEC

Web quick & secure online filing. Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact. You can expect to receive this new form from a business that paid you $600 or more for nonemployee compensation in tax year 2020 or. This article will provide you.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

A penalty may be imposed for filing with the irs information return forms that can’t be scanned. This form will be used to file next year's taxes. You can expect to receive this new form from a business that paid you $600 or more for nonemployee compensation in tax year 2020 or. Pricing starts as low as $2.75/form. Boxes on.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

If you have made a payment of. Web quick & secure online filing. Brand new for 2020 is the 1099 nec form. Get ready for this year's tax season quickly and safely with pdffiller! This form will be used to file next year's taxes.

1099 Form Independent Contractor Pdf Blank Contractor Agreement

Web print and file a form 1096 downloaded from this website; The payer and the receiver should point their names, addresses, and taxpayers. Choose a previous version to file for the current tax year; Brand new for 2020 is the 1099 nec form. Web for state tax department www.irs.gov/form1099nec (if checked) federal income tax withheld copy b for recipient this.

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

Choose a previous version to file for the current tax year; Web for state tax department www.irs.gov/form1099nec (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to. Web quick & secure online filing. See part o in the. If you have made a payment of.

What the 1099NEC Coming Back Means for your Business Chortek

Choose a previous version to file for the current tax year; If you have made a payment of. This form will be used to file next year's taxes. Web quick & secure online filing. Web print and file a form 1096 downloaded from this website;

For the Love of 1099s! Preparing for JD Edwards YearEnd Circular

01 fill and edit template. Web moreover, you're still unable to print the forms for 2023 at the end of the year since your and you're unable to receive the latest critical security patches and product. Pricing starts as low as $2.75/form. 03 export or print immediately. This article will provide you with key information and guide you through the.

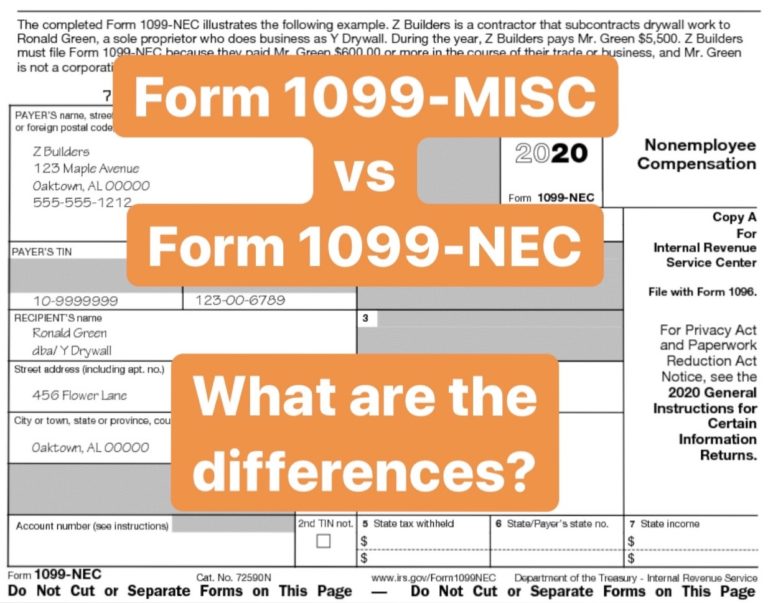

Form 1099MISC vs Form 1099NEC How are they Different?

If you have made a payment of. Brand new for 2020 is the 1099 nec form. Web quick & secure online filing. Web for state tax department www.irs.gov/form1099nec (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to. See part o in the.

TSP 2020 Form 1099R Statements Should Be Examined Carefully

Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact. Pricing starts as low as $2.75/form. Brand new for 2020 is the 1099 nec form. If you have made a payment of. You can expect to receive this new form from a business that paid you.

Understanding 1099 Form Samples

Web quick & secure online filing. Pricing starts as low as $2.75/form. Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Get ready for this year's tax season.

A Penalty May Be Imposed For Filing With The Irs Information Return Forms That Can’t Be Scanned.

Brand new for 2020 is the 1099 nec form. Get ready for this year's tax season quickly and safely with pdffiller! You can expect to receive this new form from a business that paid you $600 or more for nonemployee compensation in tax year 2020 or. Choose a previous version to file for the current tax year;

03 Export Or Print Immediately.

The payer and the receiver should point their names, addresses, and taxpayers. Web for state tax department www.irs.gov/form1099nec (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to. Pricing starts as low as $2.75/form. This form will be used to file next year's taxes.

Web Print And File A Form 1096 Downloaded From This Website;

Web moreover, you're still unable to print the forms for 2023 at the end of the year since your and you're unable to receive the latest critical security patches and product. 01 fill and edit template. If you have made a payment of. See part o in the.

This Article Will Provide You With Key Information And Guide You Through The.

Boxes on the left side of the form require the payer and recipient details such as tin, name or business name, address, and contact. Web quick & secure online filing.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)